A Guide to Alipay in China

Alipay is the leading third-party payment platform in China. It was founded on December 8th, 2004 by Ant Group, an affiliate of the Alibaba Group.

What is Alipay’s History?

Alipay started out in 2003 by providing a secure solution to simplify payment for both customers and merchants within Taobao, China’s leading online shopping platform. By acting as the third-party payment processor, Alipay accepted payments on behalf of merchants and only transferred the payment to the merchant once the customer had confirmed delivery of the product or service.

As the success of Alibaba’s e-commerce platform attracted more and more users, Alipay achieved a huge user base and established a reputation for offering secure and streamlined payment solutions, which later secured its dominant position in the mobile payment market. In 2004, Alipay was separated from Alibaba Group and has since been operating under its new parent company Ant Group.

What Does Alipay Provide Today?

2.1 A streamlined and fast payment method for both offline and online usage

In the early 2000s, offline payments in China were mainly completed by face-to-face cash exchange. Debit cards, credit cards, and online banking services faced limitations because of exclusive partnerships between banks and their respective supporting merchants.

In 2010 Alipay launched its “Quick Payment” service that kick-started the “cash to mobile payment” transition, revolutionizing the entire payment industry in China, and enabling any payment to be completed with a simple scan.

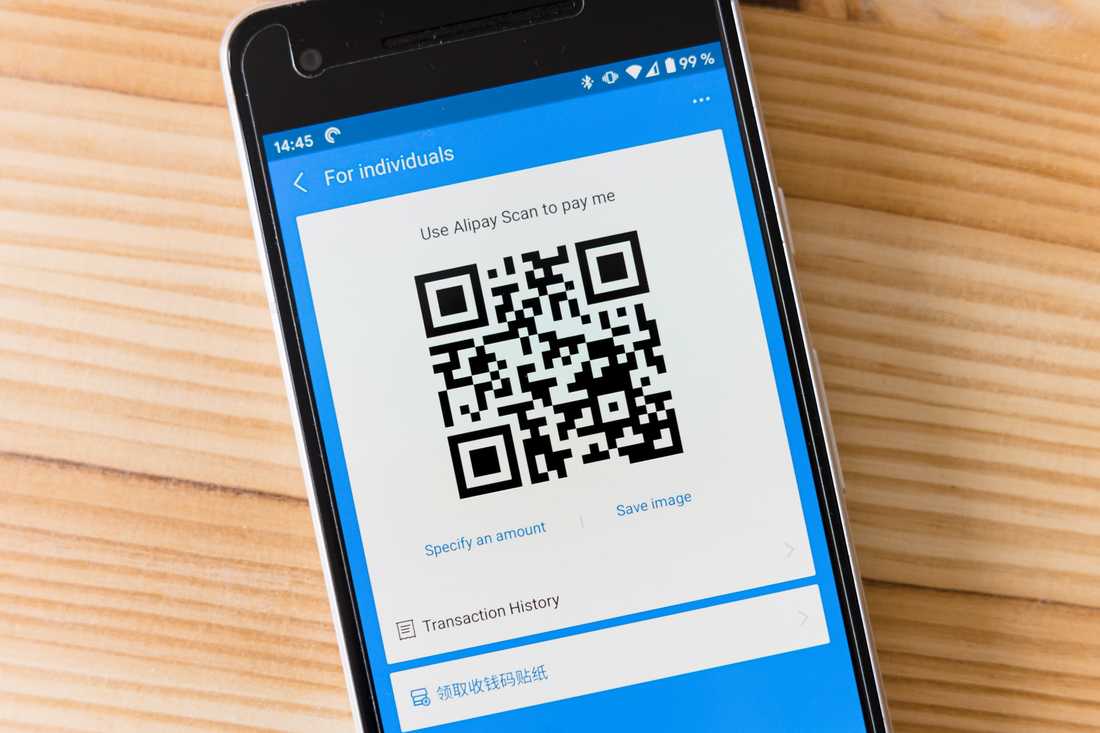

Merchants can now accept payment either by scanning the one-time QR code generated in the customer’s Alipay app or by asking the customer to scan the merchant’s static QR code, which will have been requested in advance and pre-approved by Alipay. The customer will then verify the payee and payment amount before completing the payment with a preset authentication method such as face ID, fingerprint, or passcode. The entire process can be completed in seconds.

2.2 An open platform hosting over three million mini programs offering a variety of services

The number of services you can find in Alipay is virtually limitless. Since 2018 Alipay has become a super app by including mini programs, offering a wide variety of services, within their own app. As of May 2021, there were over three million mini programs operating within Alipay. These numbers are likely to continue growing rapidly, as Ant Group stated in May 2020 that they plan to reach a total of 40 million mini programs by 2023.

2.3 A modern credit system that advances a trusting business environment and healthy social relationships

Alipay provides two key credit-related services:

- Sesame Credit

Powered by Alibaba’s advanced cloud computing and AI learning capabilities, Sesame Credit provides reliable credit data of individuals and enterprises in business scenarios where credit history is leveraged, such as determining the maximum loan that a customer can apply for and whether an individual or enterprise is qualified for certain privileged services. The connection to Alipay means that a user’s financial activities within Alipay directly contribute to his or her Sesame Credit Score.

- Ant Credit

This B2B affiliate of Ant Group focuses on assisting the government in the supervision of tech companies, establishing credit profiles for SMEs, and providing risk monitoring and compliance services. Its vast database and advanced big data technology have made Ant Credit an important resource in numerous business scenarios.

3. Alipay’s leading position in China’s mobile payment market

Chinese consumers, generally speaking, have skipped the “cash to credit card” transition that occurred in much of the rest of the world, and have transitioned directly to mobile payments. The annual transaction value of mobile payments in 2020 reached CNY 432.16 trillion, according to Statista with a year-on-year growth rate of 24.5%.

China’s mobile payment market is essentially a duopoly of two major players, with approximately 95% of payments made in Mainland China being done through either Alipay or WeChat Pay.

| Market Share | Transaction Volume (billion yuan) | |

| Alipay | 55.6% | 33,248.8 |

| WeChat Pay | 38.8% | 23,202.4 |

| Yiqianbao | 1.5% | 897 |

| 99 Bill | 0.4% | 239.2 |

| Union Mobile Pay | 0.4% | 239.2 |

| Suningzhifu | 0.2% | 119.6 |

| Others | 3.1% | 1,853.8 |

Source: http://pg.jrj.com.cn/acc/Res/CN_RES/INDUS/2020/10/9/5c0283b9-3f20-4af0-b2a6-4c4f2b91fc23.pdf

As of June 2021, Alipay had over 1.3 billion global users, more than 80 million merchants, and partnerships with over 2,000 financial institutions.

Apart from being the preferred payment platform in China, Alipay is becoming more and more indispensable due to its mini program ecosystem mentioned above, including paying for utility bills, credit card repayments, topping up phone credit, tax filing, and tracking delivery packages. For merchants, Alipay allows them to manage their accounts, customize promotional activities and analyze their finances all in one place.

Can I Use Alipay Outside of China?

4.1 Individual users

For individual users looking to make domestic or cross-border payments, they can download the Alipay app from their local Apple App Store or Google Play Store. With the exception of Hong Kong, all users around the world are using the same version of the Alipay app.

To apply for an individual account, users are required to select the region that they’re currently living in and provide their contact information. They will then be asked to verify their identity by providing a photo of their ID card or passport. They will then need to link a bank card to their Alipay account in order to enable payments and transfers. The banks and card types that Alipay supports vary from country to country.

4.2 Merchants

For merchants outside of China, offering Alipay as a payment method can help to boost revenue by providing a convenient option for Chinese users and travelers.

According to finance.sina.com, Alipay’s overseas transaction volume from July 2019 to June 2020 reached USD 6.9 billion and as of June 2020more than 200 countries around the world now accept Alipay payments.

For merchants outside of China that wish to accept payments from Chinese visitors, there are two ways to do it:

- Apply for access to the QR code payment function of Alipay and have their customers scan a QR code when making a payment

This requires the merchant to have a legally registered company outside China. They will need to fill out an online request form and provide basic information about their company, such as industry, company name, company address, contact person, and contact information. The product or service that the merchant offers must be compliant with regulations stipulated by Alipay.

- Apply for approval to integrate the Alipay online payment system into their website or app

On top of what’s needed to request access to the QR code payment function, the merchant will also need a website or app containing payment functionality. Companies that have an app but no website can instead provide a link to their app’s introduction page on the Apple App Store or Google Play.

Can I Use Alipay As A Foreign Individual or Company in China?

5.1 Individual users

If you are non-Chinese and you’re currently visiting or living in China, you can set up your Alipay account with your passport information and your Chinese phone number.

In 2019 Alipay started to accept international debit and credit cards including Visa, Mastercard, American Express, Discover, and JCB.

5.2 Foreign companies

5.2.1 Accepting payment in a physical store through a QR code

WFOE’s (wholly foreign-owned enterprises) in China can apply for a corporate Alipay account and collect payments in physical stores. The key materials needed are:

- The business license of the Chinese company

- ID information of the company’s legal representative

- Photos of the physical store

- The name and address of the store

5.2.2 Allowing customers to use Alipay for purchases within your app or website

To integrate Alipay within an app or website foreign-invested companies will need to complete the following steps:

- Create an Alipay corporate account and verify it with the business license and ID of the legal representative of the Chinese company

- Open a corporate account at a Chinese bank

- Apply for a developer account on Alipay and a unique payment ID for the app or website

- Install and configure the Alipay SDKs to integrate the payment solution into the app

Other important considerations:

- The company can be a wholly foreign-owned entity, a joint venture, or a Chinese-owned company, but it must be registered in Mainland China.

- Before considering enabling Alipay for the services you provide, you need to first complete an ICP filing to make sure that your app or website is operated in compliance with Chinese law.

- Having a high level of Chinese language proficiency will be crucial, as the backend where you manage sales and bills is in Chinese, and inquiries you submit to Alipay customer support will most likely be answered in Mandarin only.

- Alipay doesn’t offer any solution regarding currency conversion or tax submission. To pay taxes, convert Chinese Yuan to other currencies and legally transfer your money to your overseas bank account, we recommend that you hire your own trusted accountant and tax specialist.

In order to comply with local laws and regulations, Alipay’s review system is designed to be strict and thorough. The entire process can take a very long time if you don’t know what to watch out for, and the requirements listed above may not be sufficient depending on the details of your business.

AppInChina can offer a one-stop solution to bypass a lot of hurdles and legally monetize your app or website. With our international, multilingual team based in China, you can:

- No longer stress over not having a Chinese company. You won’t need one when you’re partnering up with AppInChina, a company that’s already legally registered in Mainland China.

- Set up your Alipay account easily without confusion over language barriers and studying the documents required. All we need is your app name, package name, and a few screenshots to apply an app ID for you.

- Use AppInChina’s backend system where the security of your transactions is ensured, leaving only the frontend integration to your development team, which we can also assist with.

- Use AppInChina’s API, which allows you to pull and import data into your own company’s financial software for user behavior analysis and more.

- Employ a specialist from our team to submit required taxes to Chinese authorities on your behalf and leave the money you receive as net profit.

Contact our specialists today and find out how we can help you localize and monetize your app or website.